Moving Forward: What’s next for the Fredericksburg Food Co-op?

2018 has been an excellent year for the Fredericksburg Food Co-op so far. We are seeing steady and sustained growth as we work toward our goal of reaching 1,000 or more members before opening our grocery store.

Our co-op is growing faster and more steadily than almost all of the other more than 100 startup food co-ops in the United States.

We passed the 700-member milestone in April, then the 800-member milestone in July. This progress has launched us into a more serious phase of planning. Our board is working to build a strong foundation so that our member-owned grocery store will be a strong, successful business with a clear competitive advantage to offer the market it serves.

We know that the location of the store will be very important. Our site selection committee continues to work with local commercial real estate experts to hone in on the ideal site for our co-op store.

One of the biggest keys to a food co-op store’s success is sufficient capital. Our board is putting a lot of planning right now into the mechanisms by which we plan to raise the capital we’ll need to open and operate a successful grocery store.

Food co-ops traditionally raise capital from three main sources:

- Membership investments ($200 per household)

- Member loans

- Traditional bank financing

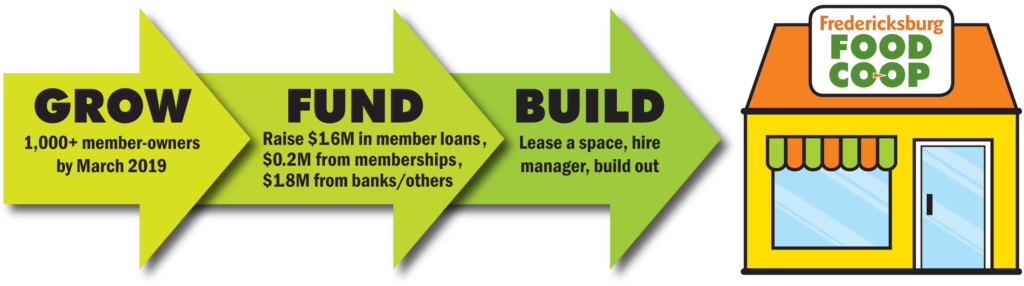

We will be using all three of these methods to raise the $3.6 million we will need prior to opening our member-owned grocery store.

Our efforts so far have focused on growing our membership, and that work won’t stop.

But soon we’ll begin to turn our focus to member loans, which we anticipate will make up about half of the $3.6 million we’ll need to open.

What is a member loan?

Very simply a member loan is a legal agreement between a co-op and a co-op member under which the member lends needed funds to the co-op and the co-op repays the loan with interest. Member loans are the traditional way that startup food cooperatives capitalize. Member loan programs are mutually beneficial. In our case, member-owners will have the opportunity to loan startup funds to the Fredericksburg Food Co-op, allowing the store to open its doors. Members will not only earn interest on their money loaned to the Co-op, but will also gain the opportunity to invest in a venture that aligns with their values while benefitting the greater community.

Why pursue member loans?

Member loan programs are a long-standing method used by food cooperatives to raise money and community support for their stores. They demonstrate the existence of a loyal customer base and reduce debt service, making the business stronger. Investment by the co-op’s membership also demonstrates to commercial lenders that the business is both financially viable and desirable.

When will this process start?

We have already begun seeking a law firm to prepare documents and other needed approvals for this member loan process. We will be working over the summer and through the fall to prepare this member capital campaign for launch. As we are doing that, we will also be working on finding a store location, and talking to banks, government agencies and other potential lenders about our financing needs.

Look for the member financing campaign to begin quietly this fall, and to roll out in earnest in early 2019, when we also hope to secure our store location.

What can you do to help in the meantime?

- Continue to tell your friends about the Fredericksburg Food Co-op. We need to maintain our member growth. The more members we gain this year, the stronger our store will be.

- Attend our annual meeting in September. Members will elect three board members to new three-year terms. You can also learn about the work our board is doing and how you can help.

- Consider making a member loan. We will have more information about this in the coming months, but we encourage you to start thinking about this opportunity to invest in a community business that aligns with your goals and values.

Published May 31, 2018.